Transform overnight batch risk processing into real-time Live Risk using Automatic Adjoint Differentiation and Automated Implicit Function Theorem. No multi-year rewrite required.

Transform overnight batch risk into real-time Live Risk in weeks, not years.

Using Automated Implicit Function Theorem (AIFT) with modern AAD enables automatic differentiation of model calibrations without code refactoring.

QuantLib integration achieves 20ms pricing + complete Greeks

for 1000 IR swaps including curve calibration on single CPU

Batch processing for portfolio risk has been standard for decades with risk reports produced overnight. But traders now demand real-time risk visibility, and legacy quant libraries weren't designed for this.

Real-world consequences of slow risk systems: Korean autocallable notes pushed over trillion Won ($810 million) of equity-linked securities into the red in Q3 2022. Better intraday risk monitoring could have enabled earlier risk mitigation.

Transitioning to Live Risk typically requires multi-year IT transformation involving major rewrites of quant libraries. This is expensive, risky, and often abandoned halfway through.

This article presents an alternative: Achieve Live Risk in weeks using Automated Implicit Function Theorem (AIFT) and modern AAD—no major rewrite required.

We demonstrate with QuantLib—a real-life production library—integrated with MatLogica AADC (modern AAD tool).

Interest rate swap portfolio with complete workflow:

Complete pricing + Greeks + calibration for 1000 swaps on single budget CPU with every market data update

This demonstrates how existing batch analytics transition to Live Risk—making traders happy with real-time risk visibility!

Two Key Technologies

Challenge: Model calibrations (implicit functions solved by minimizers/solvers) are common in quant finance but difficult to differentiate automatically.

Traditional belief: Manual intervention required to enable AAD through calibration routines—expensive and time-consuming.

Published in Risk.NET 2022 by Dmitri Goloubentsev, Evgeny Lakshtanov, and Vladimir Piterbarg—enables fully automated differentiation of calibration routines:

Live Risk requires speed. MatLogica's AADC achieves adjoint factor less than 1—meaning all risks compute faster than price alone.

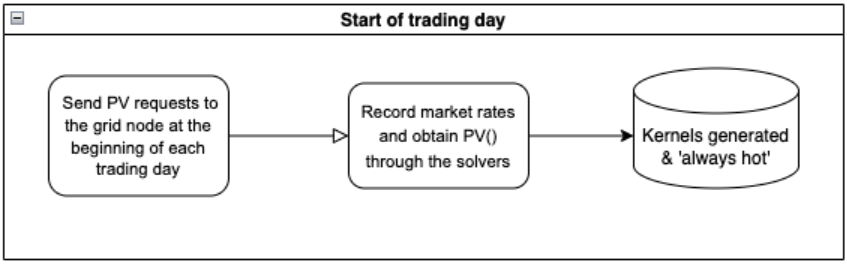

AADC generates binary kernels for forward and adjoint execution in "always-hot" state on the grid

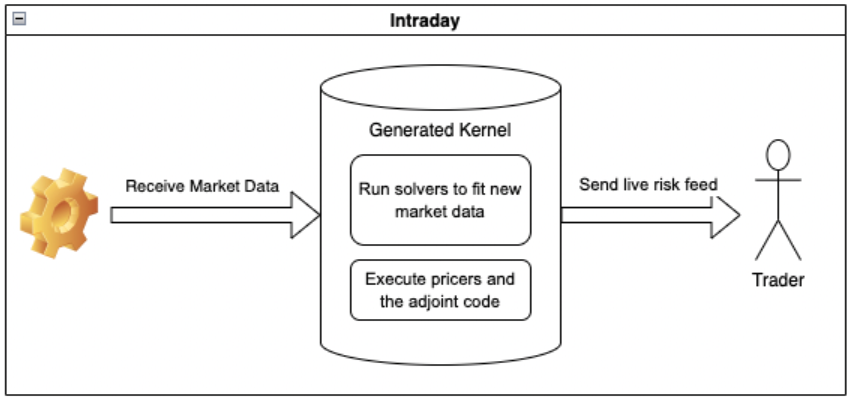

Kernel receives market data updates, runs calibration solvers, executes pricing + adjoints, returns prices and risks to traders

Note: This section provides mathematical foundations for technical readers. Decision-makers can skip to the Implementation section below.

Benefits:

Transform your batch system into "always-on" Risk Server in weeks:

Unlike traditional approaches requiring complete quant library rewrites, AIFT with AADC enables Live Risk transition through targeted integration—typically weeks to months instead of years.

Talk to us about integrating AIFT and AADC into your quant library. MatLogica assists with integration every step of the way.