Integrate custom neural networks seamlessly into your C++ analytics with AADC. Outperform TensorFlow on CPU for models up to 1,000 inputs while achieving faster training and inference for production quantitative systems.

Financial institutions face a critical dilemma: Python-based ML frameworks are too slow for production, while rewriting models in C++ is expensive and time-consuming. AADC bridges this gap.

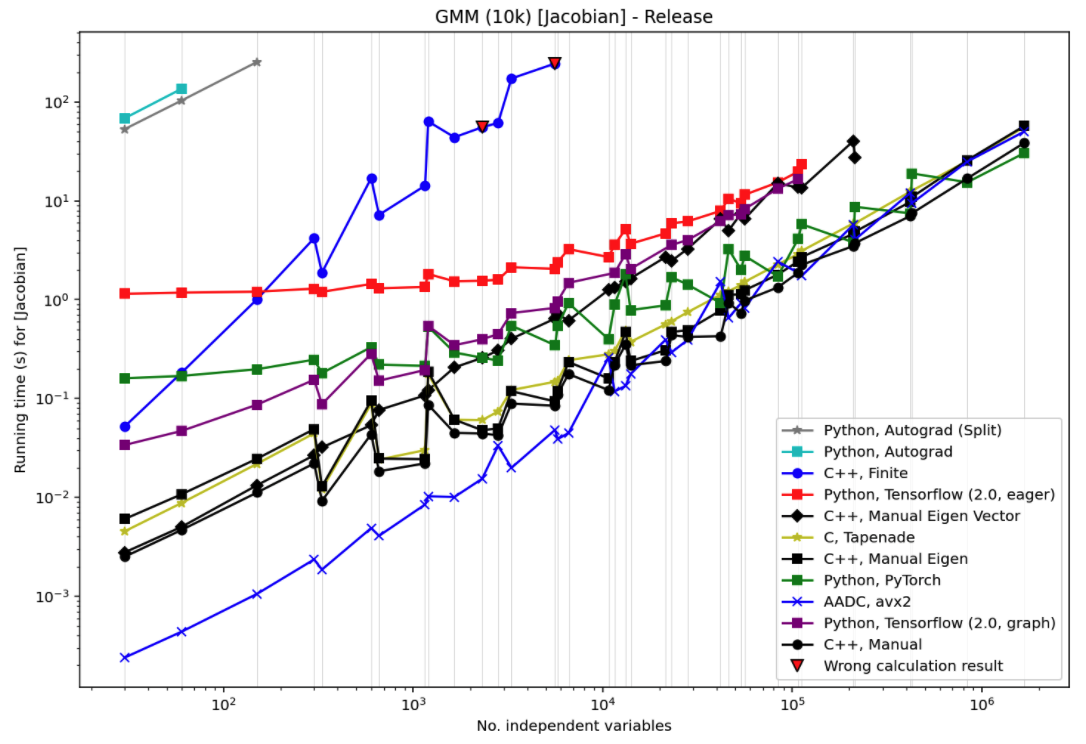

ADBench benchmark results show AADC's significant advantage for quantitative finance applications

ADBench Performance Comparison: AADC vs TensorFlow vs PyTorch

Note: Python-based tools are catching up for very large problems (computer vision, linguistics) where performance is memory-bandwidth limited, but AADC excels in the sweet spot for quantitative finance.

State-of-the-art neural network research from MatLogica and partners

Choose the approach that fits your development workflow

Build neural networks in C++ with AADC for pure ML workloads

Seamlessly interleave ML with quantitative business logic

TensorFlow and PyTorch are designed for massive models (millions of parameters). Quantitative finance typically needs models with hundreds to thousands of inputs—AADC's sweet spot.

Most ML frameworks optimize for GPUs. AADC is built for CPU performance, which is where production quant systems run. No GPU infrastructure needed.

No graph building overhead, no Python interpreter, no framework abstractions. Direct compilation to optimized machine code with automatic differentiation.

ML layers integrate seamlessly with your existing C++ analytics. No language barriers, no serialization overhead, no deployment complexity.

For quantitative finance applications

| Feature | TensorFlow/PyTorch | AADC | Advantage |

|---|---|---|---|

| CPU Performance (up to 1K inputs) | Baseline | 10x+ faster | AADC |

| Training Speed | Baseline | Several times faster | AADC |

| Integration with C++ Analytics | Complex (language barriers) | Seamless | AADC |

| Production Deployment | Python runtime required | Native C++ binary | AADC |

| GPU Requirement | Needed for good performance | CPU-only | AADC |

| Custom Layer Development | Framework-specific APIs | Standard C++ code | AADC |

| Very Large Models (>10K inputs) | Better | Good | TensorFlow/PyTorch |

| Pre-trained Model Ecosystem | Extensive | Limited | TensorFlow/PyTorch |

Note: AADC excels in the quantitative finance sweet spot (moderate model sizes, CPU deployment, integration with business logic), while TensorFlow/PyTorch are better for very large models and transfer learning scenarios.

See how AADC can deliver 10x+ performance improvements for your machine learning applications in quantitative finance.